16.12.2019

Why primary storage suppliers are consolidating – and why secondary storage is a different story

Interview Major and mature high tech industry markets consolidate to two or three major suppliers and minor players fighting for market niches left available.

Blocks & Files asked GigaOM storage analyst Enrico Signoretti for his thoughts. He mailed us his replies while waiting at Las Vegas for a plane delayed because of snow at Chicago’s O’Hare airport. Winter is coming.

Blocks & Files: Could you describe the pattern of supplier consolidation that’s occurred in parts of the IT industry, such as disk drives, tape libraries, the public cloud and Fibre Channel switches and HBAs?

Enrico Signoretti: It happens with the maturation of the market, and it is a common process for every industry. Think about airplanes for example, the market went though a massive consolidation in the last 30 years. Now you have only two major players with product line ups that can be compared 1:1 and bunch of niche players. That’s it. You mentioned tapes and HBAs, and I think it is going to happen for primary storage as well.

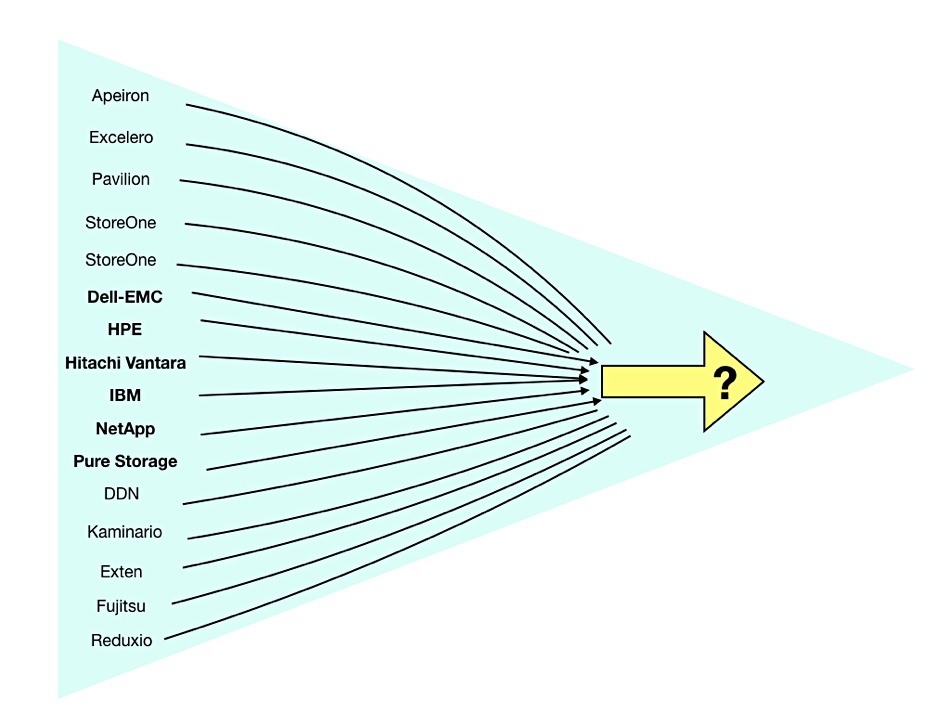

A selection of some storage suppliers, with the mainstream players in bold type. Which ones will pass through the consolidation gate?

Blocks & Files: If mature parts of the IT industry consolidate to just two or three major players is it likely the same pattern will happen in primary storage?

Signoretti: The signs are already there, it started to happen a few years ago and it will accelerate in the next two-three years. Think about Hitachi Data Systems, for example. Their product line up saw a contraction and now they practically have only two storage products (VSP 5000 and HCP).

They strategically chose to move higher in the stack focusing on IoT, data management, and big data analytics, now storage is just instrumental to their overall strategy. And, as far as I can see, it is paying off. Their products are still top-notch but you won’t see any major uptick in market share.

NetApp is another good example. With its Data Fabric vision, it is pursuing a similar strategy but with the goal of giving options for data mobility and management across on-prem and cloud.

Blocks & Files: Will the same trend take place in secondary storage, data management software and data protection. Or will these be included in a general storage supplier consolidation?

Signoretti: Secondary storage is a different story at the moment. There is a lot going on here. New startups (like Cohesity, for example) are really disrupting the status quo; object storage is living a second life (performance, data management features, etc.); and new innovative scale-out file systems are gaining a lot of attention as well. The market is very dynamic and most of these solutions fits pretty well in hybrid cloud strategies and machine learning initiatives of most organisations.

Blocks & Files: What would a major player in a consolidated primary array storage industry look like? What product features and business models would it possess?

Signoretti: The few that will remain will have a broad product line-up, able to cover most of the use cases. They will compete more on overall stack efficiency than features. Also financial aspects will be more important than the single feature. Everybody is working on these cloud-like consumption models. It won’t be for all end users but, as soon as you accept to get availability, SLAs, capacity, and IOPS instead of a box to manage, then technical details on how the vendor does it will become less and less relevant.

At the end of the day, you don’t really care how Microsoft, Google or Amazon run their cloud if you can get what you ask for, do you? And if storage vendors want to replicate the same experience on premises they will also have to accept the consequences.

Blocks & Files: What will happen to existing suppliers who are not destined to be major players? Should they actively seek acquisition?

Signoretti: That is tough to answer. Some vendors will have to face this soon anyway. We are talking about enterprise storage here. But if the business will shrink and become less profitable they will sell their business to somebody that can support end users for a few years?

Or some Chinese manufacturer will step in trying to work on improve manufacturing and sales processes? Sell single products (and teams) one by one? I’m pretty sure it will be an opportunistic approach for these vendors.

Blocks & Files: In the worst case what will happen to non-acquired minor suppliers?

Signoretti: They could become niche players or they will just become irrelevant over time.

Blocks & Files: Should suppliers realistically evaluate their status and likely end point and develop an active strategy to get their or avoid it? I.e. by moving into a non-consolidating part of the storage industry?

Signoretti: 2020 and 2021 will be crucial for the future of this industry. As I said, some vendors already started to evaluate their situation and started to look at how they could become more relevant for their customers and move up in the stack.

With this I mean they are actively looking at hybrid cloud, data management and governance, analytics, and more. Somehow we can say that storage hardware is becoming less relevant for them too.